Tracking business expenses is an integral part of business accounting. This is where expense reports come in.

Our guide to expense reports outlines their purpose and structure, reviews how to create one manually, and includes a few free expense report templates to help you get started.

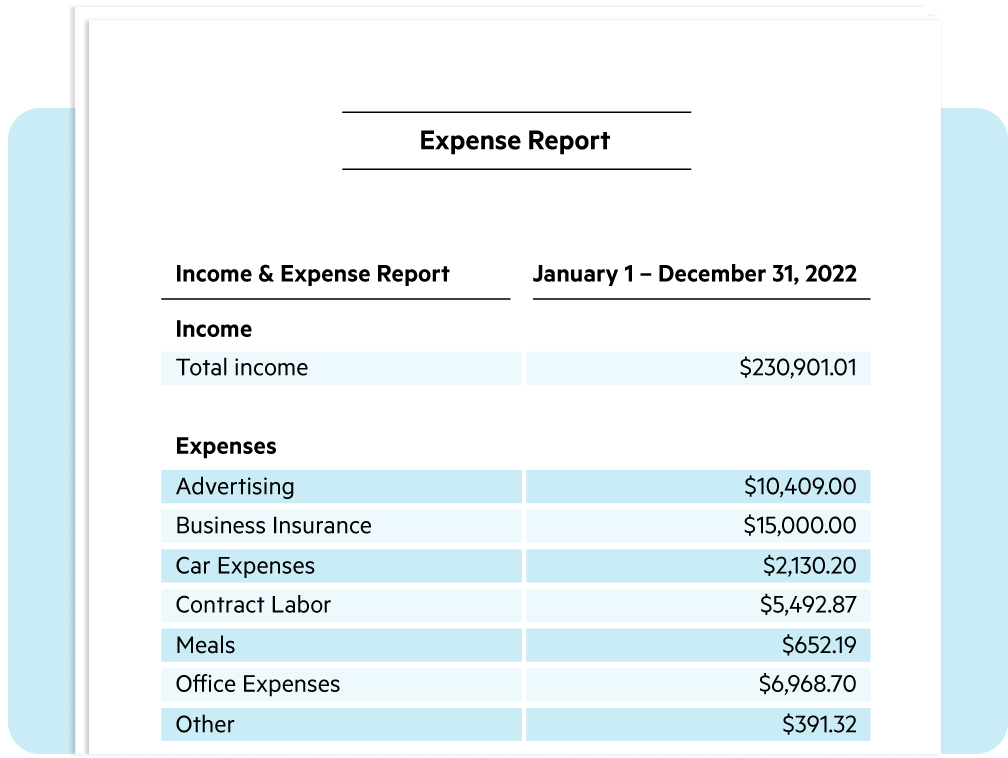

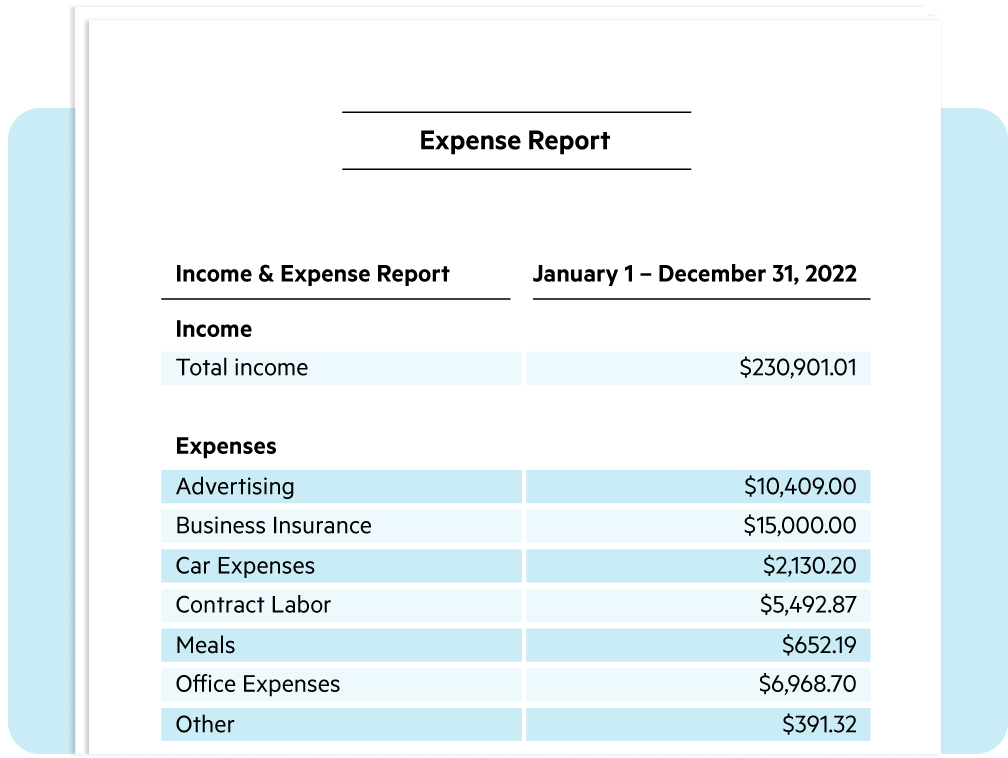

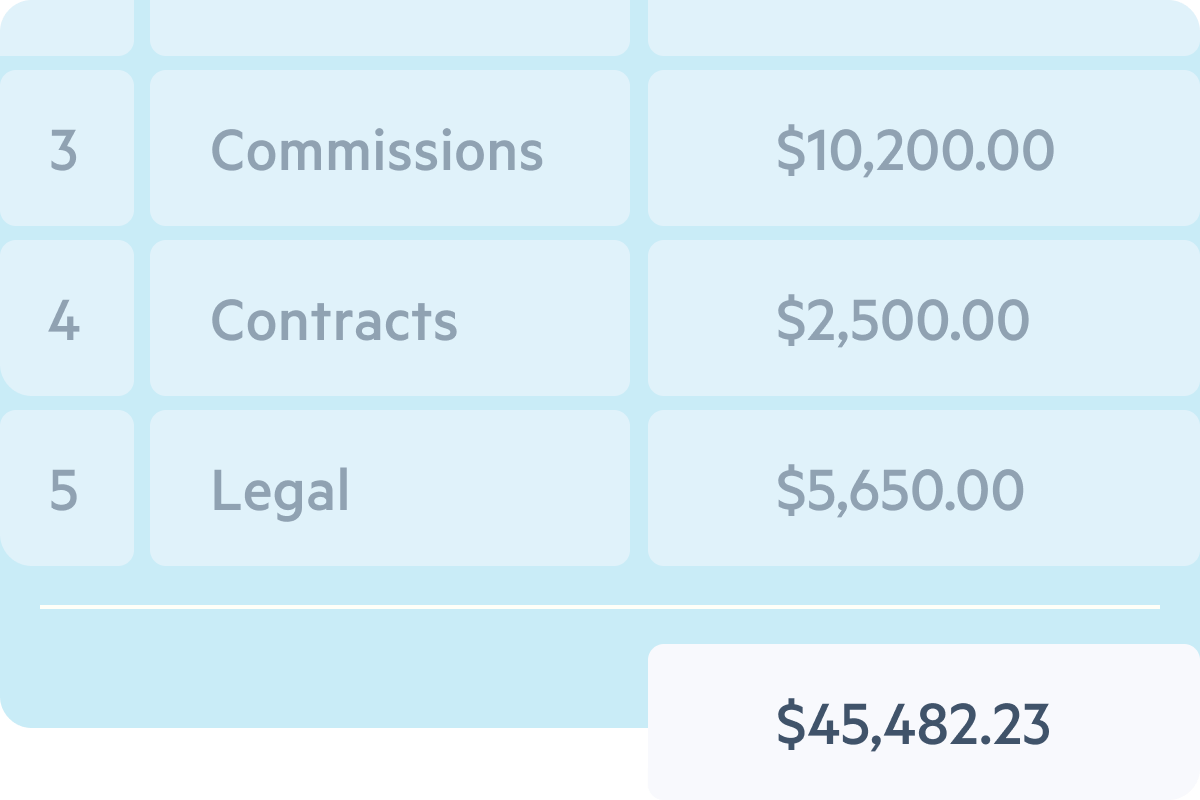

An expense report is a form that enables a business to organize and track business-related costs. Expense reports contain an itemized list of expenses and are typically generated monthly, quarterly, or annually–especially if you have employees who need to be reimbursed for business-related expenses.

Expense reports can be used to track a variety of business-related costs, such as:

Expense reports concentrate all business expenses in one document and present them in an organized, clear manner. Even if you don’t have a large team, this is crucial for any business, as proper expense reporting not only helps avoid the organizational challenge of keeping track of each individual invoice, bill, and receipt (as well as the risk of losing any of them), but also facilitates proper budgeting and spend control. And, come tax season expense reports ensure a smoother tax preparation process.

What is the purpose of expense reports?An expense report is most frequently used either by employees to request reimbursement for business-related expenses or to track write-offs for annual tax deductions.

Employees need to keep track of business-related expenses so they can request reimbursements at the end of each quarter. This may include dinners with clients, mileage driving to and from the office and various job sites, gas and other transportation expenses, hotels for business trips, and anything else they need to do their job. Employees will often submit their expense report to their finance team along with receipts as proof of each expense reported.

All businesses—whether or not they have employees—can use expense reports to keep track of write-offs for annual tax filing. These can be the same as expenses employees may report (and will include any reimbursements made to employees), but will also include larger scale business expenses such as rent, utilities, insurance, equipment, and other business purchases.

Regardless of the size of your business, an expense report is a great way to track and summarize business expenses. This can help you better understand where your money is going to help you cut costs or adjust how you allocate your funds.

This simple expense report template provides a straightforward layout that enables an employee to list and tally business expenses according to category and provide expense details including the category, a short description, and comments.

Built-in formulas sum up expenses per category, per day, and allow for the inclusion of any advances received before calculating total reimbursement.

Add daily expenses to this monthly expense report in order to produce an organized overview of monthly expenditures. This template provides sections for income as well as expenses by category, with built-in formulas displaying the total per section and overall.

This expense report template provides an organized overview of quarterly expenditures. Built-in formulas display the income and expense totals according to category as well as overall.

This expense tracker template allows for a simple, ongoing record of expenses that can be used on a daily basis. The running tally makes it easy to quickly assess total expenditures.

This simple expense report template provides a straightforward layout that enables an employee to list and tally business expenses according to category and provide expense details including the category, a short description, and comments.

Built-in formulas sum up expenses per category, per day, and allow for the inclusion of any advances received before calculating total reimbursement.

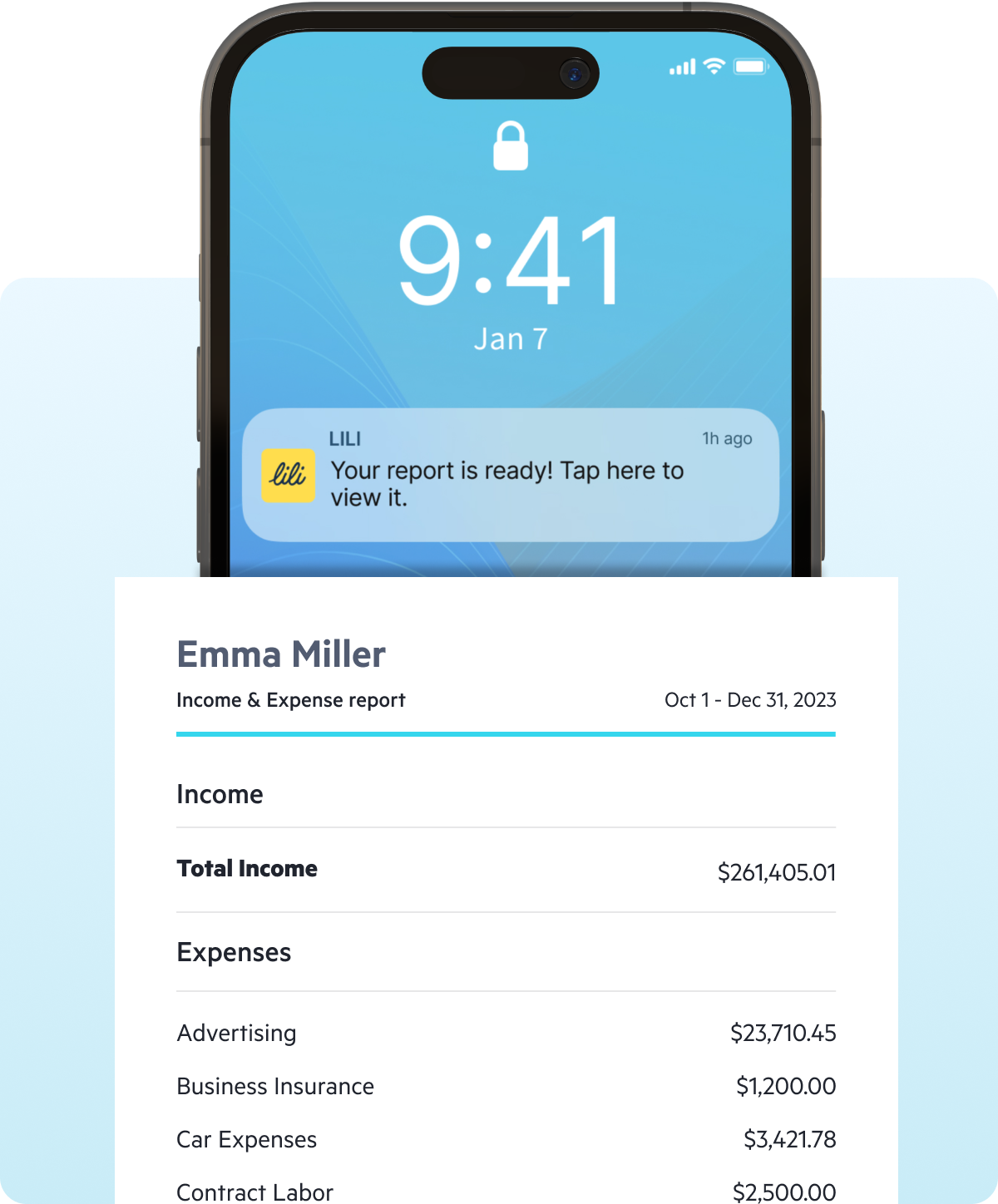

Simplify your bookkeeping with instant transaction categorization, and gain clarity about your business’s financial status with income & expense insights and auto-generated financial reports. Make it easier to balance your books with Lili’s Accounting Software.

Below is a step-by-step guide to manually creating an expense report.

Start by choosing your preferred format for the report, or by selecting from one of our free expense report templates. Fill in all applicable identification details including your company name, your name, and the date range to which the expense report applies.

Make sure all of the sections are relevant to what you will be reporting, and adjust the section names to fit with your unique business needs. Include a column for identifying the IRS-specific category for each expense, such as:

Collect bank statements for the expense reporting period. This will make it easier for you to find each expense and all the information you need to include on your expense report.

Start adding your expenses to the expense report, filling in all the necessary information for each individual expense. Report your expenses in chronological order with the most recent at the end—this is especially helpful if you intend to report as you go rather than at the end of a year or quarter.

If you’re filling out an expense report manually, you’ll need to calculate the total expenses for the reporting period at the end, especially when requesting reimbursement or reimbursing an employee. With our free expense report templates, the total will automatically be calculated.

Double-check that all the information included is correct, then save the report and submit it to the relevant parties. Be sure to attach all relevant receipts when sending the report for reimbursement.

Creating a simple expense report involves recording basic information about each expense, including:

You can find a downloadable template for a simple expense report in the Expense Report templates section of this guide.

You can create an expense report using Excel by following these simple steps:

You can then submit your complete expense report, created using Excel, along with the receipts attached.

Yes, you should keep receipts in addition to producing expense reports. While expense reports list and organize business expenses, receipts act as proof of these expenses, and are used as supporting documents when claiming business tax deductions. A business would also need to produce receipts in the event of an audit. Note that you do not have to keep physical records of receipts, digital records are sufficient.

With Lili, storing receipts takes a matter of seconds. Anytime you use your Lili card, you can simply scan your receipt and attach it to your transaction–enabling you to stay organized, effortlessly!

Creating a simple expense report involves recording basic information about each expense, including:

You can find a downloadable template for a simple expense report in the Expense Report templates section of this guide.

Filling out an expense report can take valuable time and energy. Lili’s accounting software automates expense reporting with monthly, quarterly, and annual expense reports available.

By using Lili to track and report business expenses, you can keep all your transactions and bank statements in one place and even scan receipts to attach to expenses digitally. Say goodbye to scrambling to collect bank statements and track down a bunch of loose receipts, and say hello to expense tracking made simple with Lili!

Fill in some basic personal information.

Tell us about your businessShare a few details including business type, EIN and industry.

Select a planChoose the account plan that best fits your business.

Contact Us

Mon – Friday, 9am – 8pm EST

About LiliLili is a financial technology company, not a bank. Banking services are provided by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC. The Lili Visa® Debit Card is issued by Choice Financial Group, Member FDIC, or Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A., Inc. Please see the back of your Card for its issuing bank. The Card may be used everywhere Visa debit cards are accepted.

Wire Transfer service provided by Column Bank N.A., Member FDIC. All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A. or Lili App Inc.

1 Available to Lili Pro, Lili Smart, and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

2 Available to Lili Smart and Lili Premium account holders only, applicable monthly account fee applies. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of September 1, 2023. Must have at least $0.01 in savings to earn interest. The APY applies to balances of up to and including $100,000. Any portions of a balance over $100,000 will not earn interest or have a yield. Available to Lili Pro, Lili Smart, and Lili Premium account holders only.

4 BalanceUp is a discretionary overdraft program for debit card purchases only, offered for Lili Pro, Lili Smart, and Lili Premium Account holders. You must meet eligibility requirements and enroll in the program. Once enrolled, your Account must remain in good standing with a deposit and spending history that meets our discretionary requirements to maintain access to the feature. BalanceUp overdraft limits of $20-$200 are provided at our sole discretion, and may be revoked any time, with or without notice.

5 Early access to ACH transfer funds depends on the timing of payer’s submission of transfers. Lili will generally post these transfers on the day they are received which can be up to 2 days earlier than the payer’s scheduled payment date.

6 Up to $1,000 per 24 hours period and a maximum of $9,000 per month. Some locations have lower limits and retailer fees may vary ($4.95 max). Note that Lili does not charge transaction fees.

7 Lili AI and other reports related to income and expense provided by Lili can be used to assist with your accounting. Final categorization of income and expenses for tax purposes is your responsibility. Lili is not a tax preparer and does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your specific situation.

8 Lili does not charge debit card fees related to foreign transactions, in-network ATM usage, or card inactivity, or require a minimum balance. The Lili Visa® Debit Card is included in all account plans, and remains fee-free with the Lili Basic plan. Applicable monthly account fee applies for the Lili Pro, Lili Smart, and Lili Premium plans. For details, please refer to our Choice Financial Group Account Agreement if your Lili business deposit account was opened with Choice Financial Group, Member FDIC, or Sunrise Banks Account Agreement if your Lili business deposit account was opened with Sunrise Banks, N.A., Member FDIC.

9 The Mail a Check, Outgoing Wire Transfers and Invite Your Accountant features are only available for Lili business deposit accounts opened through Sunrise Banks, N.A., Member FDIC.

© 2024 Lili App Inc. All Rights Reserved.