MetLife's Total Control Account (TCA) is an interest-bearing, no fee* account designed with beneficiaries in mind. Although not a bank account, it's a lot like a checking account, but with several advantages. Your loved one trusted MetLife with their life insurance or annuity, and to provide you with assistance during this difficult time. There’s no better place to protect and grow those funds than a MetLife TCA.

Video Content English Video Spanish Video English Video Spanish Video

Although not a bank account, your TCA functions similarly to a checking account in a bank, with respect to your account access and ability to withdraw your funds.

* Special services fees may apply only for the following: draft copies ($2), stop payment of drafts ($10), overdrawn TCA ($15), and overnight delivery service ($25.)

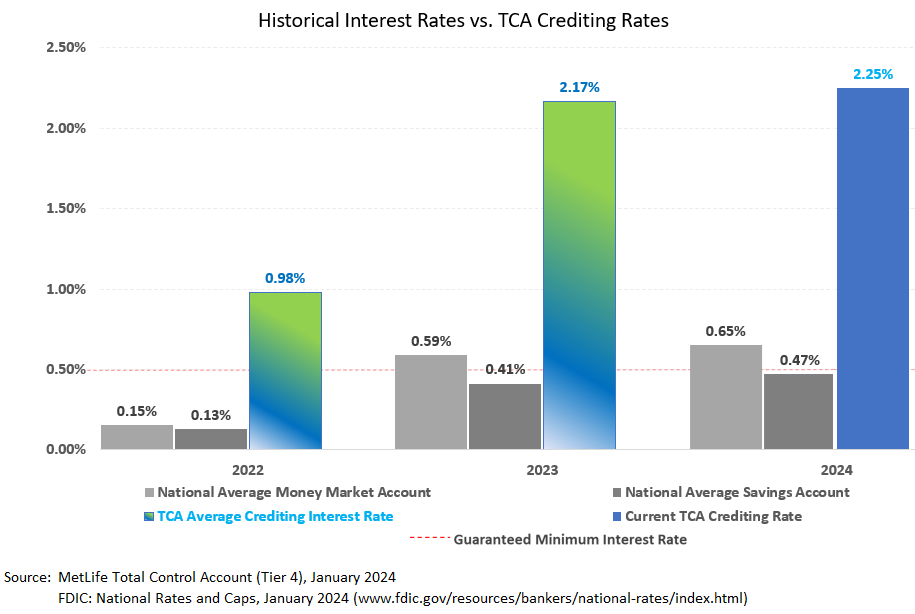

Accountholders benefit from a guaranteed minimum interest rate of 0.50% (a half percent)* - which can be higher than the interest rate received on a standard checking/savings account.

*The customer agreement included in each TCA Welcome Kit contains details about the interest rate.

The easiest way to access your funds.

The debit card offers you a safe and convenient way to access your money. With the Visa debit card, you can make everyday purchases and payments and get cash from an ATM with no fees. Enjoy peace of mind knowing that you’ll receive a proactive SMS text alert message if we suspect fraud.

Once you have a TCA account, you can order a Visa Debit Card by clicking here or by calling 800-638-7283.

Your TCA can serve as a legacy after your loss. You can use the funds for meaningful purchases or keep the account open and earning interest without using the funds, and then pass it along to your beneficiary(ies).

I keep my TCA as a savings for the future…” 2Current TCA Accountholder Testimonial

With a TCA, life insurance proceeds begin earning interest as soon as the account is established, and the TCA interest rate is often higher than what banks pay on savings and checking accounts. TCA also provides support and flexibility to beneficiaries. They can easily access funds, as needed, to pay for expenses or they may decide to save and grow their funds for use at a later time.

There is no cost to having a TCA. There are also no maintenance fees, no ATM surcharges, and no charge for withdrawals or drafts. * Special services fees may apply only for the following: draft copies ($2), stop payment of drafts ($10), overdrawn TCA ($15), and overnight delivery service ($25.)

Yes, your account earns competitive interest. Your account begins earning interest the day it's established. We update our interest rates weekly to ensure that they are competitive, and the interest is compounded daily to give you a higher return.

MetLife fully guarantees the funds in your account (principal and interest earned). MetLife has been helping protect people’s financial security since 1868, and the TCA is backed by the financial strength of MetLife. In addition, the funds in your account are guaranteed by your state insurance guaranty association. The coverage limits vary by state. 3

No. Funds for your TCA can only come from a life insurance claim or annuity closeout. When you withdraw money from your TCA, you won’t be able to redeposit it into the TCA or deposit funds into your TCA. So, if you have a checking or savings account earning less interest than your TCA, you may want to use that source before withdrawing money from your TCA.

Call 800-638-7283

Monday through Friday

from 8:00 a.m. through 6:00 p.m. ET